Tax Planning For A Newly Married Couple

Going from a single filer to a married filer changes a lot of things in terms of taxes. New tax rates, new income limits, new contribution limits. There are some tax planning steps to take when going from single to married filing jointly (MFJ). Taking the time to adjust your financial strategy now can lead to long-term savings and help you avoid potential surprises down the road.

File Your Taxes Jointly or Separately?

One of the first decisions you'll make is whether to file jointly or separately. Fun fact: If you get married on December 31st, 2025, then in the eyes of the IRS you have been married for the entire year of 2025. Here's what you should consider:

Married Filing Jointly (MFJ)

Most couples benefit from filing jointly. It often results in a lower tax rate, and you’ll qualify for higher deduction limits and credits. However, there are certain situations where being married but filing as married filing separately (MFS) makes sense.

The Standard Deduction in 2025

Single Filer = $15,000

MFJ = $30,000

Married Filing Separately (MFS)

Filing separately may be beneficial in some specific situations (e.g., if one spouse has significant medical expenses, miscellaneous deductions or if one spouse has income-based student loans).

However, this status often disqualifies you from tax credits like the Child Tax Credit, the Earned Income Tax Credit, and certain deductions.

Generally, MFJ provides the best tax benefits for most couples, but you may want to consult a professional to see if filing separately makes sense in your situation.

Name and address changes

If you want to change your last name, you should report it to the Social Security Administration as soon as possible. The name on a person's tax return must match what is on file at the Social Security Administration. If it doesn't, it could delay any tax refund.

Maximize Tax-Advantaged Accounts

Tax-advantaged accounts allow you to reduce your taxable income and grow your savings more efficiently:

Retirement Accounts

401(k) or 403(b): If either spouse has an employer-sponsored plan, maximizing your contributions can help to reduce your taxable income.

IRA: Contributing to a Traditional IRA can also help to lower your taxable income, though the ability to deduct contributions has income limits.

Roth IRA: Contributing to a Roth IRA can provide tax-free growth and withdrawals in retirement, though income limits apply.

Read more about choosing Traditional vs Roth here:

https://www.moneymattersfortwo.com/p/traditional-vs-roth-which-one-do-you-pick

Health Savings Account (HSA)

If you have a high-deductible health plan (HDHP), contributing to an HSA can be a good idea. HSA contributions are tax-deductible, the money grows tax-free, and withdrawals are tax-free, if used for medical expenses.

Read more about HSA accounts here:

https://www.moneymattersfortwo.com/p/health-savings-accounts-hsa-for-newly-married-couples

Tax Credits for Married Couples

Child Tax Credit: If you plan to have children, this credit provides up to $2,000 in 2025 per qualifying child under the age of 17.

Earned Income Tax Credit (EITC): For low-to-moderate-income couples, this credit can reduce your tax liability, especially if you have children. In 2025 (taxes filed in 2026), the maximum earned income tax credit amounts are $649, $4,328, $7,152 and $8,046, depending on your filing status and the number of children you have.

Lifetime Learning Credits: The Lifetime Learning Credit is a tax break for tuition and mandatory fees to attend post-secondary institutions (after high school). This can be up to $2,000 per year in non-refundable tax credits.

Adoption Credit: If you're adopting a child, you may qualify for a non-refundable tax credit of up to $17,280 in 2025, depending on your income.

There are more credits out there however, the ones above are usually the most common.

Adjusting Your Tax Withholding

W-4 Form: Review your W-4 form with your employer to adjust your tax withholding. This can be as simple as letting them know you want to go from a single filer to MFJ. This will usually automatically adjust your withholdings.

If you are self-employed, using a tax calculator can help you understand how much to set aside for taxes.

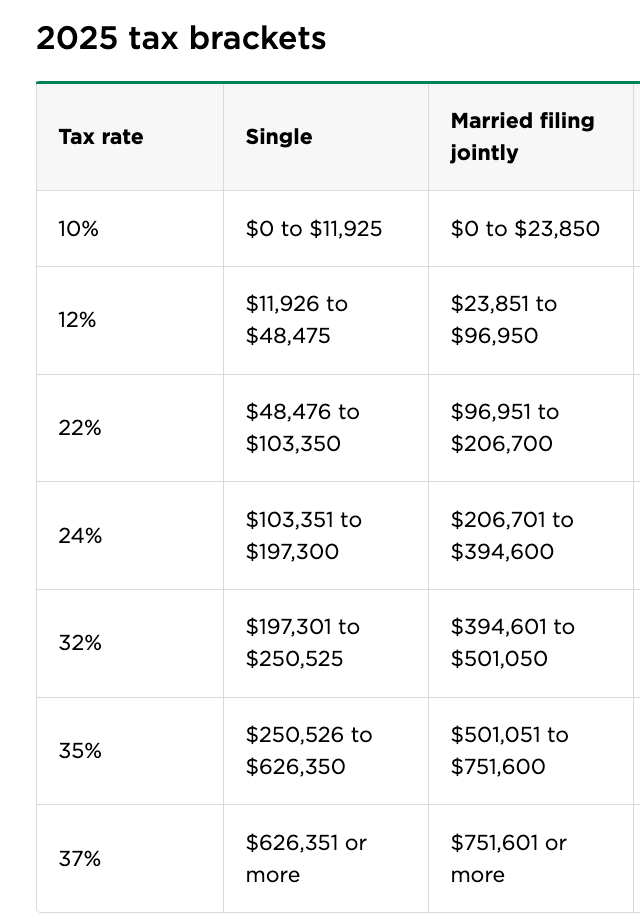

Tax Brackets: When going from a single filer to MFJ, your tax brackets change.

In 2025, going from single filer to MFJ changes the 24% bracket from $103,351-$197,300 to $206,701-$394,600. This is usually more beneficial to tax payers, which means potentially less taxes you are paying.

Review Your Standard vs. Itemized Deductions

For most couples, taking the Standard Deduction is more advantageous than the Itemized Deduction (This may change in the future).

For 2025, the standard deduction for a married couple filing jointly is $30,000. If your deductible expenses (mortgage interest, medical expenses, charitable contributions, etc.) are higher than this, consider itemizing. If not, stick with the standard deduction.

Capital Gains Tax

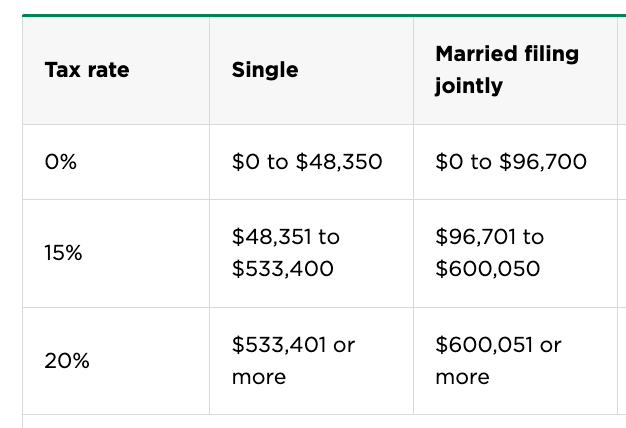

Capital Gains Tax: If you plan to sell investments, consider the tax implications of long-term vs. short-term capital gains. Holding investments for over a year may reduce the tax rate on gains. Going from single filer to MFJ changes your long term capital gains tax table:

Consult With A Professional

Taxes can be confusing & it can be easy to make a mistake. Having a good financial team around you can help you make the right decisions for your tax situation. Pairing a good financial planner with a good CPA can help optimize your tax situation by being proactive with your tax planning. This can help you maximize your tax savings and ensure that your financial life together is on the right track.

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to get organized on your finances, read this post: Getting Your Finances Organized As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice or tax advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.