Investment Planning For A Newly Married Couple

Investments are an important part of your financial plan. Investment planning is all about considering risk tolerance, time horizon, and selecting appropriate investment options that will grow wealth over time to achieve your financial goals. Investment planning is more than just throwing darts at a dart board to pick stocks. It is more than just picking the stocks you see on CNBC. It is more than just picking the 5 biggest companies on the stock market. Investment planning is understanding multiple inputs to carefully select a investment plan that will help you achieve your goals.

Define Your Financial Goals

Before you start investing, it’s crucial to align your investment strategy with your short-term and long-term goals.

When it comes to short term goals, investing money in equities (think stocks) is usually frowned upon. If you need the money within 3 years, investing it is usually not a good idea.

Long term goals are usually focused on retirement planning, but can also include funding your children's education or leaving a legacy via an inheritance.

Understand Your Risk Tolerance

Both partners should have a discussion about how much risk you are comfortable taking with your investments. There are plenty of risk tolerance questionnaires you can take to see where you score on risk. It is a good idea for each person to take a risk tolerance questionnaire without the other persons input.

Risk tolerance varies depending on age, financial situation, and goals. A younger couple might have a higher risk tolerance because they have more time to recover from potential losses.

Build a Diversified Investment Portfolio

Diversification is a key principle in investing. By spreading your investments across different asset classes, you reduce risk. For example, if you place all your money into one company, you are not diversified. Your financial future depends entirely on one company. However, if you were to buy a broad market ETF, this means your money is spread out across many (usually hundreds) of companies. If one of those companies fails, you have hundreds of others still holding their value. The more risk you are willing to take, the higher potential for reward… however also the higher potential for loss.

Equities, or better known as stocks, are the most common type of investment, offering potential for high returns but also come with high risk.

Bonds are typically safer and provide more stable returns than stocks. However, the returns are generally lower.

Real estate can be a great way to diversify beyond traditional stocks and bonds.

As you grow more comfortable with investing, you could consider adding other alternative investments like:

Commodities (gold, oil, etc.)

Cryptocurrency

Private Equity

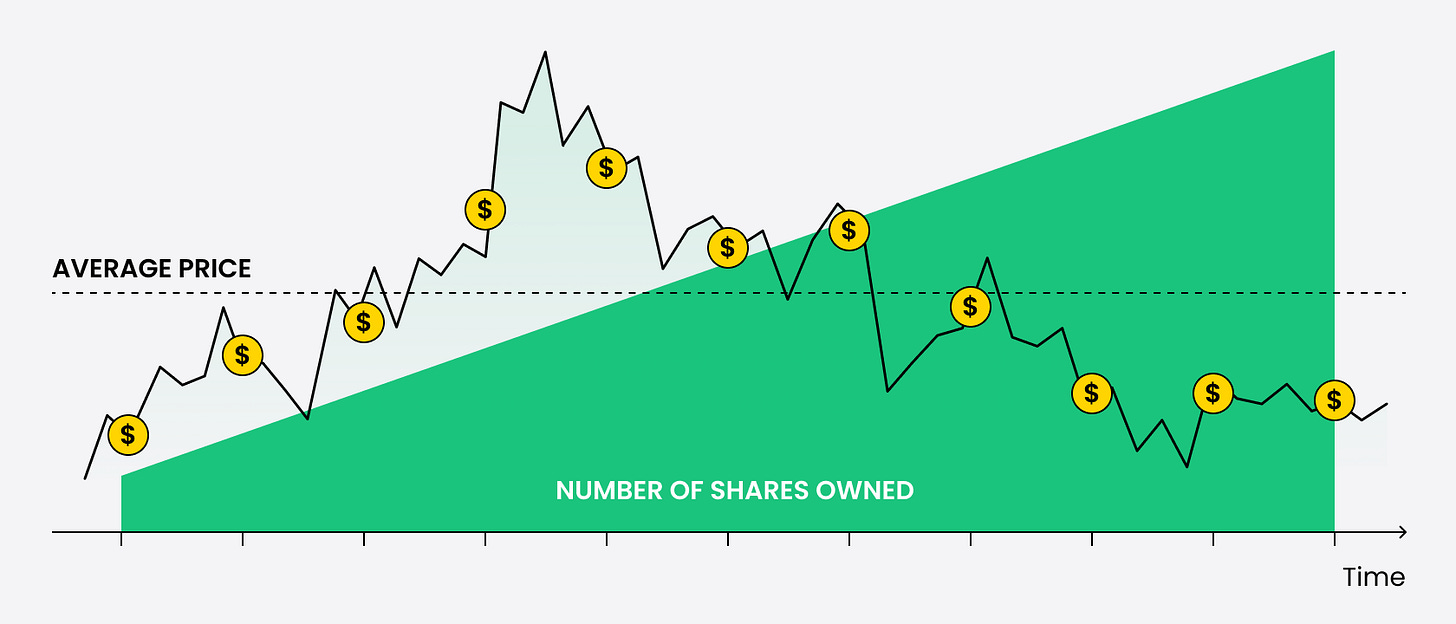

Dollar-Cost Averaging (DCA)

This is a strategy where you invest a fixed amount of money at regular intervals regardless of if the market is up or down. If you are investing into your 401(k)/403(b), then you are DCA’ing already, because you are buying an equal amount on a consistent schedule. DCA helps you to avoid attempting to time the market + it allows you to take advantage of market dips and buy more shares when prices are low.

Another way to DCA is to set up auto investing. Every week, every other week, each month you auto invest a certain amount into your portfolio. It does not matter if the market is up or down, you just buy no matter what.

Invest in Low-Cost Funds

There are many different investing styles. Some people only want to buy individual stocks. Some people only want to buy mutual funds. Some people like low-cost index funds. To me, most people are better off buying low-cost, passive ETFs. These are “boring” but building wealth is boring. These funds typically offer:

Diversification across many sectors and companies.

Lower fees compared to actively managed funds (think 0.68% expense ratio vs 0.05%, which can save you tens of thousands of dollars over the life of your portfolio)

Investing More vs Chasing Returns

It may seem like chasing high return stocks is the way to wealth, but that is usually not the case. I have worked with 100s of couples who have $1,000,000+ invested (and a few with $10,000,000+ invested). They did not chase high returns. They chased investing more with “boring” market returns. Why? When you get more money invested, you don’t have to chase high risk stocks.

Let’s compare two investors. One with a $10,000 portfolio. One with a $100,000 portfolio. The first investor chases high risk with their $10,000. They get lucky and the stock they bought goes up 50% for the year. Their $10,000 is now worth $15,000. The second investor goes the “boring” route and takes on waaaaaaaaay less risk. They get a “boring” 9% return for the year. Their $100,000 is now worth $109,000.

Even though the first investor took on insane risk that worked out in their favor (the individual stock could have also went down 60% in the year too), they only had $5,000 in gains. The second investor had way less risk, yet still had $9,000 in gains. How? They had more invested.

Of course, getting more invested takes time. However, this example demonstrates that as you get more invested, the need to chase high returns gets lower and lower. Plus, chasing high returns means you are taking on a lot of risk. Everyone loves to talk about the upside of risk, but no one likes to talk about the downside potential of risk.

Review and Rebalance Your Portfolio

Your portfolio allocation might need adjustments as your financial situation evolves or as the market changes. There are two stages to investing. The accumulation stage and the decumulation stage.

The accumulation stage is all about buying more and growing your wealth. You are wanting your assets to grow, so you may be willing to be more in equities vs bonds to achieve this growth.

The decumulation stage happens usually in retirement, where you are focused on withdrawing money from your portfolio to maximize after tax money + you are probably more into bonds/safer investments than someone in the accumulation stage.

It is a good idea to occasionally review your portfolio to make sure the holdings and allocation are what you expect them to be. As the market fluctuates and certain stocks/funds do better, you may become overweighted in one area than another. Depending on the account type & tax situation, it may make sense to rebalance, or utilizing tax-loss harvesting, to make sure your portfolio is allocated how you want it to be.

Investing Something Is Better Than Investing Nothing

Just start. There is power in getting compound interest on your side. Maybe you can only do $100 a month. Maybe you can do $500 a month, but you have never invested before. Just starting & getting compounding working for you, rather than against you is very powerful. Open that 401(k), open that IRA, open that taxable brokerage account & start investing today.

If you are unsure where to begin with your investing, not confident to do it yourself, or want guidance on your investment strategy, this is where a fee only, fiduciary financial planner can help you.

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to get organized on your finances, read this post: Getting Your Finances Organized As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice or tax advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.