Insurance Planning For A Newly Married Couple

Insurance protects you and your family from unforeseen events and provides a financial cushion. When it comes to insurance planning, there are many things to think about/review/update/add when you go from single to married. Even if you are not changing your insurance policies yet, it is good to review them periodically to ensure they are covering what you want them to cover & that you are properly insured. Once you add kids into the picture, the insurance planning gets even more important.

Life Insurance

When going from single to married, life insurance becomes more important. Even more so when kids/dependents come into the picture. The purpose of life insurance is one thing and one thing only: Replace your lost income if you die so your loved ones won’t suffer financial hardship after you’re gone.

When it comes to life insurance, there are a few different options: Term, Whole Life, Universal, Variable etc. Let me say this: The vast majority of people will only need term life insurance. If you meet with a disguised financial advisor, they will probably try to sell you on one of the other life insurances. Why? Well, they earn a bigger commission check to do so. They will say the other insurance types will allow you to “borrow from yourself” or “investment like returns without the downside risk”. Don’t fall for it. Most people just need term insurance & invest the savings into the stock market for a bigger nest egg.

An easy way to decide the term life insurance death benefit amount is to take 10x the salary of each person. For example, if one spouse makes $100,000, then getting a $1M term life insurance policy is usually not a bad idea.

However, it depends on many factors. Maybe there is a mortgage still, so throwing that into the death benefit amount can be a good idea. Maybe there are 2 kids who need college funding still. Maybe the couple has $1,500,000 in assets already & no mortgage, so a smaller death benefit will suffice. This is why it is a good idea to talk to a flat fee, no commission, fiduciary financial planner to get recommendations based on your situation.

Health Insurance

When you get married, you will qualify for a “special enrollment period”. This will allow you and your spouse to make changes to your current health plan. It might make sense to both go on one spouse’s plan or the other spouse’s plan. It may make sense to each stay on your own for health/cost purposes. Here are some things to think about on health insurance:

Healthcare Needs & Usage

Unequal Needs: If one spouse has chronic health conditions or requires frequent medical care, having a more comprehensive plan might be necessary, even if it's more expensive.

Low Usage: If both spouses are generally healthy and have minimal healthcare needs, a lower-cost, more restrictive plan might suffice.

Children: If you have children, consider which spouse's plan offers better coverage and network access for pediatric needs.

Plan Costs & Coverage

Premium Costs: This is the cost you pay each month to have coverage.

Deductibles: A deductible is the amount of money you must pay out-of-pocket for covered medical expenses before your insurance plan starts to cover costs.

Coinsurance: Coinsurance is a portion of the medical cost you pay after your deductible has been met. Co-insurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100%. The higher your coinsurance percentage, the higher your share of the cost is.

Maximum Out of Pocket: This is the most you could pay for covered medical expenses in a year. This amount includes money you spend on deductibles, copays, and coinsurance. Once you reach your annual out-of-pocket maximum, your health plan will pay your covered medical and prescription costs for the rest of the year.

Network Access: Ensure that your preferred doctors and specialists are in-network for both plans, especially if you have specific needs.

Coverage for Specific Needs: Consider whether each plan covers specific procedures, medications, or treatments that you or your spouse may need.

Financial Considerations

Tax Implications: Understand any tax implications related to health insurance premiums or health savings accounts (HSAs).

HSA: If you are enrolled in a High Deductible Health Plan (HDHP), then you can contribute to an HSA. Read more about the benefit of an HSA here: https://www.moneymattersfortwo.com/p/health-savings-accounts-hsa-for-newly-married-couples

Out-of-Pocket Costs: Consider the potential for high out-of-pocket costs if you have a chronic condition or experience an unexpected illness.

Disability Insurance

Disability insurance provides a financial safety net by replacing a portion of your income if you become unable to work due to illness or injury. Many companies offer short-term disability insurance as part of their employee benefits package, and about half of large and mid-sized employers include long-term disability in their benefits packages. Here are some reasons why disability insurance is important to have:

Financial Security: Disability insurance helps cover expenses like mortgage payments, utilities, and other necessities when you can't work, preventing financial hardship.

Peace of Mind: Knowing you have financial security in case of an unexpected illness or injury can significantly reduce stress and anxiety.

Protection for Dependents: If you have a family or dependents, disability insurance ensures they can continue to have their needs met, even if you are unable to work.

Long-Term Financial Planning: Disability insurance can help you maintain your long-term financial goals, such as retirement savings and paying off debts, even if you experience a disability.

It is a good idea to review your company’s disability coverage to make sure it covers what you want it to cover or if you even have coverage.

Homeowners or Renters Insurance

Homeowners or renters insurance is important to review when you get married. Maybe you are looking to buy a home, then this is also a good guide to make sure you have the right coverage on your home/rent.

Update the Policy: When you move in with someone in a house, whether it be a spouse or another significant other, you need to add both people to the homeowners insurance policy. If only one person is on the policy, the other person can’t file a claim when there’s damage to the house. It’s important that every adult is capable of filing a claim in the home they live in.

Liability Coverage: If you're renting or owning a home, check if the policy covers personal liability in case of accidents on your property.

Auto Insurance

When you get married, it can be a good idea to shop for new auto insurance for bundles that may be out there for a “multi-car” household. Or other discounts that are available for married couples.

Combine Policies: If you both own cars, bundling your auto insurance policies with your homeowners can lead to discounts. Married people are often seen by insurance companies as more stable and, therefore, less of a risk.

Coverage Needs: Review your coverage levels. You may need to adjust depending on the value of your cars and your combined driving habits. Maybe you can increase your deductibles, which should lower your premiums, since you have more cash flow to pay for minor accidents to your vehicle.

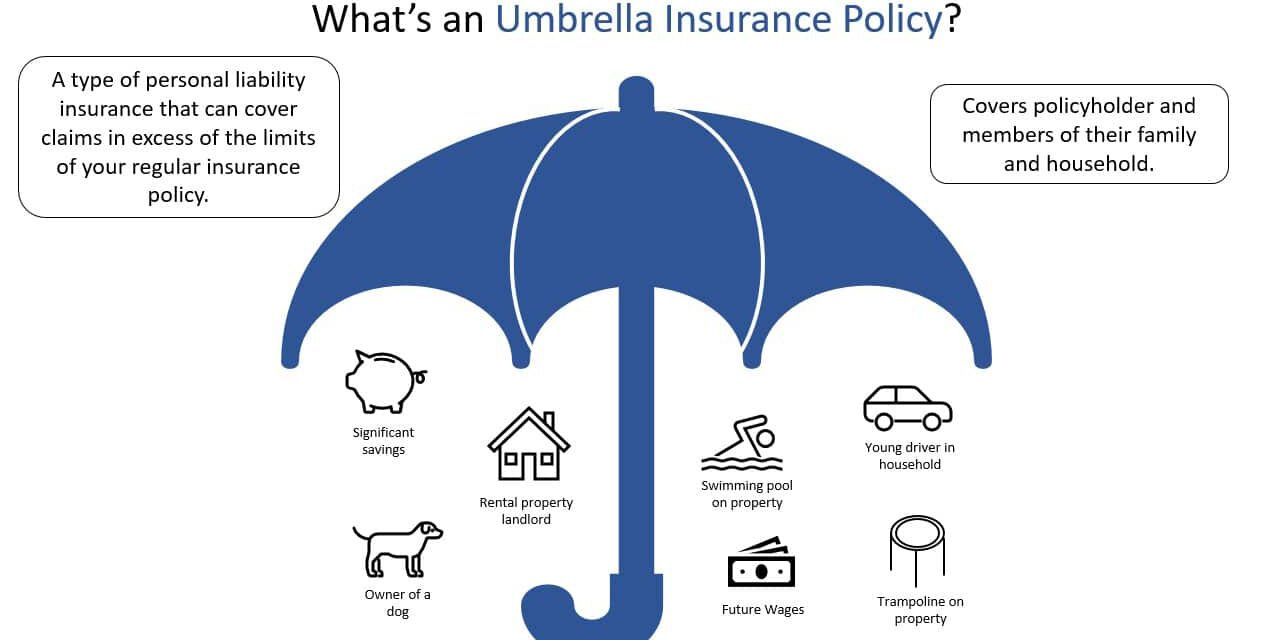

Umbrella Insurance

Umbrella insurance is extra liability insurance that kicks in after your primary insurance policies have reached their limits, providing additional protection against lawsuits and claims for damages or injuries. It can be especially useful if you have significant assets to protect, a high-risk lifestyle, own rental properties, or have children drivers.

Umbrella coverage starts at $1M & is sold usually in increments of $1M. However, it is not as expensive as you may think. A $1M insurance coverage usually costs less than $500 a year.

Beneficiaries

With all the changes happening with your insurances, it is very important to update the beneficiaries on the polices as your life changes. If you already have a term life insurance policy, make sure to go in and update the beneficiary to your spouse.

When you are married, you typically drive each other’s vehicles, live in the same house, and want your spouse to get financial assistance from your life insurance. You should always make it a priority to add your spouse to your insurance policies.

Future Thinking

If you plan on having children, consider the potential need for additional life or disability insurance, as well as funding for college savings plans. These are future things to think about as your family grows & more changes happen. Financial planning for your life is constantly evolving.

Where To Go For New Insurance Policies?

A great place to go when you get married to shop for new policies is an independent insurance broker. This is someone who can shop multiple carriers to find you the best coverage for the best price. A quick Google search can direct you to some names of insurance brokers in your area. It is always a good idea to shop for new insurance coverage every few years to make sure you are getting the best coverage for the best price.

Insurance planning is very important because it is protection for you and your family. When you get married, it is a great idea to review, update or change your insurance policies to fit your new situation. Consulting with a fee-only, fiduciary financial planner to help guide you through this process is a great idea.

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to get organized on your finances, read this post: Getting Your Finances Organized As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.