401(k) Contributions - How Much They Save You In Taxes

When it comes to investing into a Traditional 401(k), one of greatest benefits is the tax benefit you get when you make the contribution. Let’s say you make $20,000 worth of contributions to your 401(k) in 2025. This means for tax year 2025, you will get to deduct $20,000 worth of income from your taxable income. That is pretty powerful!

The misconception that most people have is a $20,000 contribution to a 401(k) means you pay $20,000 less in taxes. That is not true. Contributions to your 401(k) is a tax deduction, not a tax credit.

Tax deduction: A tax deduction reduces your taxable income. By lowering the amount of income that is subject to tax, it can decrease the overall tax bill.

Example: If you earn $150,000 as a household and have $30,000 in 401(k) contribution deductions, your taxable income becomes $120,000. The tax is then calculated based on the $120,000, not the $150,000.

Tax Credit: A tax credit directly reduces the amount of tax you owe, dollar-for-dollar.

Example: If you owe $10,000 in taxes and you qualify for a $500 tax credit, your tax bill is reduced to $9,500.

Now that we know how deductions work, let’s look at how to calculate the tax savings you get from contributing to a 401(k):

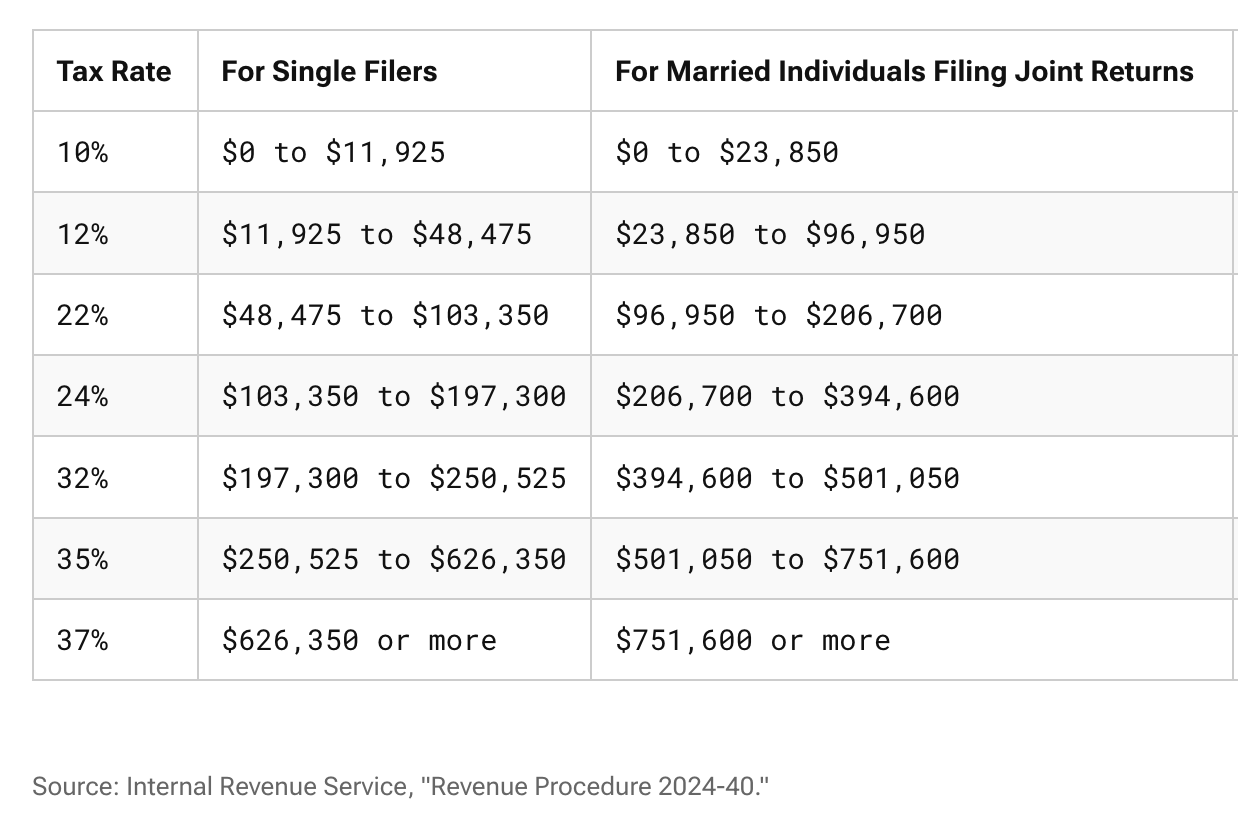

To find out how much a 401(k) contribution saves you in taxes, you need to know your marginal tax rate. Your marginal tax rate is the rate at which your highest dollar of taxable income is taxed at. For example, if you are married filing jointly and your household taxable income is $247,000 then you would be in 24% tax bracket. If your household taxable income is $475,000 then you will be in the 32% tax bracket.

Once you know what your tax bracket is, you can do a calculation to see how much 401(k) contributions will save you in taxes. Let’s take a married filing jointly couple who has taxable income of $475,000. This would put them in the 32% tax bracket. If they contribute $23,500 to each of their 401(k)s, which would be $47,000, then their tax savings would be $15,040. How you find this number is by taking your 401(k) contributions and multiplying it by your tax rate.

Another example is John & Kim. They are both 36 years old. They live in Chicago, Illinois and their household income is $205,000. They take the standard deduction ($30,000 for 2025) & have no other income or credits they qualify for. This would make their taxable income $175,000. They would be in the 22% tax bracket.

If they were to put $10,000 into a traditional 401(k), then they would save $10,000 * 22% = $2,200 in taxes.

If they were to put $20,000 into a traditional 401(k), then they would save $20,000 * 22% = $4,400 in taxes.

Contributing to a Traditional 401(k) will lower your taxable income, which in turn will lower your taxes owed for the year. However, that does not mean you will never pay taxes on that money. On the other hand, if you contribute to a Roth 401(k), you do not get a tax deduction at all for the current tax year. However there are other benefits to a Roth. When it comes to picking a Traditional vs Roth 401(k), it isn’t as simple as close your eyes and choose. Read this blog to find out how to pick which one: https://www.moneymattersfortwo.com/p/traditional-vs-roth-which-one-do-you-pick

Another big benefit of the 401(k) is the match component. However that is not covered on this blog. I have another blog, which you can read here about 401(k) matching: https://www.moneymattersfortwo.com/p/is-a-401k-match-worth-it

Thanks for reading & I hope you found value in this post.

-Kolin

If you are looking to get organized on your finances, read this post: Getting Your Finances Organized As A Newly Married Couple

Disclaimer: The content provided in this blog post is for educational purposes only and should not be considered as financial advice or tax advice. While every effort has been made to provide accurate and up-to-date information, the content on Money Matters For Two is based on personal research, opinions, and experiences. The financial landscape can change rapidly, and what may be applicable at the time of writing may not necessarily be applicable in the future.

Any financial decisions you make based on the information provided here are entirely at your own risk. Money Matters For Two encourages readers to do their own research and, when necessary, seek the advice of a qualified financial advisor or professional to ensure that any financial choices are appropriate for their individual circumstances.